..still waiting to sell our house…

Listing Agents here in the Palm Springs Valley of California are everywhere! How do you know what to look for when you decide to sell your property? It’s not that difficult to put together a “blow your skirt up” listing presenttion. That simply requires time. It’s much more difficult to put together experience, references, and of course trust.

1. Is your Listing Agent hungry? Some Agents have so many listings that they simply cannot focus enough attention on YOUR property! Other Agents with many listings have a staff set up to manage them, but how badly do they want to sell YOUR property?

2. Does your Listing Agent use the Web? Seriously use the web? Paper ads in the newspaper and Real Estate mags are a supplementary advertisement to their exposure on the web. Where is their Website ranking? Where is their brokerage website ranking?

3. How long has your Agent sold homes in your City? There are so many different developments in each City that you wouldn’t expect an Agent to have sold in all of them. But selling in your particular part of the Valley is pretty important.

The onsite offices are not necessarily the best choice for the Agent to sell your home. They can become pretty laid back about marketing..expecting buyers to walk in. You may very well garner more exposure with an Agent that works the entire City because of their internet precense and social media precense.

Times have changed. The Agents with the most listings ACTIVE, may not be as strong as the Agents with the most listings that are Contingent, Pending, and certainly SOLD!

More

..another homes SOLD!

Inventory is low..lucky to have 3 months of inventory where a normal inventory amount of homes for sale is about 5-6 months at the low end. I think we will continue to see more inventory listed as we approach season (this is very normal for the desert market). I sure hope so! There is built up Buyer demand in all price points so more homes for Sale..if they’re priced right, will just ease demand..

Valley Prices up 20%!!!! (Courtesy of The Desert Sun)

More

I often hear, and believe, that our Palm Springs Valley offers something for everyone. And so it is with Desert Island in Rancho Mirage. One of a kind, this 226 unit condo complex built in approx. 1971, on Bob Hope and Frank Sinatra in Rancho Mirage, consists of 3 hi-rise buildings, each with it’s own heated pool/spa.

I often hear, and believe, that our Palm Springs Valley offers something for everyone. And so it is with Desert Island in Rancho Mirage. One of a kind, this 226 unit condo complex built in approx. 1971, on Bob Hope and Frank Sinatra in Rancho Mirage, consists of 3 hi-rise buildings, each with it’s own heated pool/spa.

Condo sizes range from approx. 1500 sf to approx. 3000 sf with some penthouses coming in at near 5,000 sf. Prices range from approx. $170,000 to approx. $1,000,000 for penthouses.

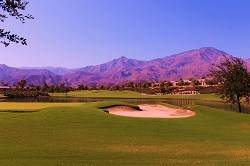

What’s the draw?? Desert Island is nestled on a lush, green 25 acre island right in the middle of Rancho Mirage!! The island is surrounded by a mesmerizing lake, which is encircled by a 110 acre, 18 hole Championship, private golf course! Wow!

Desert Island offers many amenities for it’s approx. $845/month HOA.

Interested? Give me a call at 760-285-3578 to schedule a showing of any of the Condos currently available for sale.

More

The Palm Springs & La Quinta Valley housing market is recovering..

I like to keep up with my local Palm Springs Valley statistics too, but I found this chart very interesting..it actually looks at the number of active Brokers. We are at the lowest rate since 2007! I was around in the boom when every other person you met was a Realtor. I think many people were not doing Real Estate as a career, but rather a “part time” supplement to their income..flipping or representing family/friends.

Take a look at these statistics..

In my local market here in the Palm Springs Valley, even vacant land is beginning to generate calls, and that’s something I haven’t had happen in almost 3 years! My ranch/small farm listings in the East Valley are being toured and I expect I will receive offers this season. Land is always the last thing to turn around in a housing crash, so land sales are very indicative of builder and investor confidence returning.

More

The Debt Forgiveness that people with Foreclosures and Short Sales on their Primary and investment proerties have been enjoying since 2007 expires the end of 2012. What’s going to happen? It’s an unknown. It would seem that the Debt Forgiveness would be extended since it is one of the primary reasons that people have been able to re-organize and get back on their feet.

But..there is NOTHING logical about the Lenders I we know all too well from working Short Sales for the pasat 4, almost 5 years. If they see that it will affect their own bottom lines, I suspect it will be extended. In the mean time, be sure you get your Short Sales closed by 12/31 of this year.

More

In July, contracts to buy previously owned homes rose to their highest level in more than two years… suggesting that the Housing Market Recovery is Making Headway.

The Pending Home Sales Index set by the National Association of Realtors, based on contracts signed in July, rose 2.4 % to 101.7 – the highest level since April 2010… and just before the deadline for the home buyer tax credit.

With gains in home construction and sales and prices, the report was just the latest one to show momentum in housing market recovery. Pending home sales were up 12.4% year-over-year in July.

Monthly increases in home buying activity were seen in all regions except for the West. . . this is because of the extreme lack of inventory there. The West saw a 1.7% drop in contracts last month. Contracts in the Northeast gained 0.5 % last month and the Midwest increased 3.4%. In the South, contracts rose 5.2%.

More

Market Stats for the Palm Springs Valley

It would appear that looking into our rear view mirrors, we can now see that the 4th Quarter of 2011 was very likely the “bottom” of our local real estate market. Consistent housing reports continue to support that fact that our local price/sf is going up and in many different price points. Most notably, the entry level homes which are approximately $200,000 and below. Sellers are moving back into the drivers seats!

Low Inventory is the number one factor behind this price/sf increase in all price points except perhaps, the Luxury homes. Even in the luxurry home market however, the homes with the most desireable orientation (for maximum sun), great views and homes in good condition are selling. Buyers appear less cautious and Sellers appear more realistic in their prices if they want to sell.

More

Number of foreclosures across the Palm Springs Valley fell significantly in July at a rate of 24.5% from July 2011. A new report shows that this marks 12 months of double-digit declines. The 753 bank repossessions, notices of default and trustee sale notifications that were issued in July were down from 1,096 issued in July of 2011.

A more limited inventory is available because of this drop in foreclosures for sale. Prospective buyers are not finding the availability of foreclosures to choose from that they once did.

The sustained drop in repos, trustee sales and default notices doesn’t translate to a drying up of available foreclosures for sale any time soon, according to real estate experts.

The valley here experienced a slight decline of initial default notices last month- there were 335 compared to 344 in July of 2011.

Experts say that many people are continuing to be challenged with getting banks to offer them loan modifications that would work for them – so they just aren’t paying. When that happens, the banks issue notices of default, but don’t complete the foreclosure process. Experts say that the banks are trying to get people to short sale their home rather than go through a full foreclosure.

Short sales and bank-owneds have recently accounted for far fewer of overall home sales than a year or two ago. Local experts expect more short sales and fewer foreclosures in the coming few years. They are seeing homeowners who are 20 to 30% underwater receiving loan modifications including principal reductions – but they say homeowners who are 50% or more underwater will short sell, as they will never get enough principal reduction to make keeping their home a viable option.

Contemplating short selling your home? Then consider using an agent who is knowledgeable and experienced in Short Sales and has a good track record of closing the deals. Contact Kim Kelly with HK Lane Real Estate – she Lists, Negotiates and CLOSES her deals. Call her now for a free consultation. You’ll be glad you did !

More

Beautiful land..Palm Springs Valley

Here in the Palm Springs Valley, we LOVE our foreigners..and apprently, they love us right back. Property buyers from Canada, Asia, China, Europe, Australia, New Zealand..and I even have a client coming over from Central America in a couple weeks..wow! But..I already knew we were selling Land, Ranches & Residential properties soI was pleasantly surprised when I read this morning about how the Foreign Investments in our Business community are pumping alot of dollars into our local economy.

More

Short Sales could slow down if principles are reset..a good thing!

I’ve been saying this for the past 3 years or so..why not reset mortgage principles to say…Fair Market Value + 20%? When I ask my underwater homeowners if they’d stay in their homes if THEY could get the Short Sale value I’ve proposed to them, they always respond “Yes!”

This article from New York Times today hits on this idea in San Bernardino County..which has just declared bankruptcy by the way, so might be a good place to test this eminent domain idea.

The stumbling block is always the same…the bankers get their skirts blown up “even thinking about letting the governement step in to take control of our mortgages.” Well..somebody has to! If the Banksters want to continue to set their own mortgages, why not work out a program with the current homeowners to keep them in their homes? Turn a non-performing asset into a performing one??? The reason could be that the Banksters do not want to report the TRUE VALUE of their assets to their prized shareholders until they are good and ready. Hey..a little coloring outside the lines for the Banksters is nothing new, right???

Until Mortgage values are reset, if you are underwater, give me a call for your free Short Sale consultation..760-285-3578.

More