I sell houses. There..I’ve said it. Sometimes when I tell people this, they look at me knowingly and I can just imagine that they are equating my job with that of a used car salesman or woman. There ARE those Realtors..but I am not one of them. I am a Realist and I have been very uneasy over the past several seasons saying anything at all like “we are recovering!”

Watching the La Quinta market recover

Even I, however, am beginning to think that we will be looking in our rear view mirrors and saying, “2011..that was the bottom.” It does appear that the housing market is stabilizing..all over California according to this article from the LA Times today.. In my own area of the Palm Springs Valley, I am experiencing this upswing daily. The Low End-say $250,000 and under is incuring multiple offers on nearly every home. If a Buyer is trying to purchase with an FHA loan, they will be offering way over List Price and even then, the odds are low they’ll be chosen. Cash & Conventional Loans kick FHA to the bottom of the pile for Sellers.

Even Investors are seeing the market changes. They can no longer make their numbers work..why? Because there aren’t any obscenely under priced homes for sale! The middle tier..$500,000-$850,000 is settling too. Great views and locations are being snapped up. The Luxury Market is still in flux and those Buyers are still pretty fickle..believing they can get a better price if they just wait.

La Quinta and the Palm Springs Valley in general is on the upswing..

More

B of A gives principal reductions???

Bank of America NEVER “gives” anything away for nothing. So..I suspect the devil will be in the details with this new little gig. Part of the 26 billion dollar governement settlement, Bank of America is offering 200,000 lucky homeowners that qualify principle reductions. Isn’t that nice of them???

Unfortunately, alot of things must happen…

1. The borrower has to receive, open and read their letter that they are sending in the mail. I would suspecst that many of these “select 200,000 borrowers” have already jumped ship. If they are still there, they are pretty much hiding from their Lender and are OVER getting mail from them. Wonder how many will even open the letters?

2. You have to qualify. We all know about the qualifying process with B of A for Loan Mods and Short Sales. I suspect the paperwork is huge and the negotiator numbers are not.

3. They will write off up to $100,000..yippee! That will help some, but in my area of the Palm Springs Valley, $100,000 isn’t much..in ANY price point.

Let’s see if this program is a little more efficient that Bank of America’s 48 hr. buyer substitution program is. That is a complete disaster. But..I’m an positive thinker and I choose to believe this one is “going to work!” Good luck to all!

More

81-375 National Dr. short sale

Seller just accepted an offer on 81-375 National Dr., La Quinta, CA. Now the work begins in ernest for your Short Sale Listing Agent.

1. Seller receives list of required documents including financial docs, hardship letter and lender specific documents..all of which they already have a list of. Now it’s time to gather them up!

2. Buyer’s Agent receives copies of relevent docs.

3. Lenders packages are put together (two loans here..two packages)

4. Lenders packages are scrutinized and then submitted. One is online, one is via dinasour fax.

5. Follow ups are scheduled and relentlessly held to..

Remember that the Listing Agent in a Short Sale is your key to success. Both for the Short Sale seller as well as the new Short Sale buyer. We need to be organized, tenacious, and of the “never say die” mentality.

And the ride begins!

More

La Quinta's property values have increased..

Our Palm Springs Valley is rising it’s real estate value head..good for everyone living here or owning here. Buyers still get great value, but their selection is not as great and the price/sf has inched up a bit. It has become a very competitive Buyers’ market in La Quinta, California.

The Valley’s median home price, (half sold for more, half for less) was $210,000 in March. UP from $195,000 in February..a substantial increase. More luxury homes are being sold which pulls the median up. Across the entire valley, approx. 1,152 homes sold in March, a 3.3% increase from March of 2011. The big indicator? New Homes actually started selling! Approx. 60 new homes closed in March of 2012..that’s fantastic!

La Quinta Sales Statistics for March, 2012:

Total Sales: 166 Change from 2011 was up 19.4%!

Median price: $322,500 Change from 2011 was up 13.2%!

Highest priced Sale: $3,300,000 Median price/sf is up about 6% to $155/sf

If you are thinking of purchasing a vacation home or even moving up to a larger, or smaller, or newer property..2012 may be the year to actually do it! I am seeing a significant reduction of choices in all price points. Multiple offers are becoming the norm, so don’t try to “lowball” the Seller. Offer fair market value and make your offer clean and easy for the Seller. You’ll have a much better chance of success!

More

la quinta home buyers; multiple offers

La Quinta and the Palm Springs Valley is on fire. The entry level price point used to be saturated with inventory..up until about mid 2011. Last quarter of 2011 and first quarter 2012 and now to second quarter..things have changed. The mid price ranges..$500-$800,000 have largely moved laterally. Meaning there is still inventory and the price/sf has not changed dramatically over the past 18 months or so. Luxury properties and super luxury properties have come down and are selling. However, they will most likely see more price decreases through 2012.

The entry level however has more buyers than it has inventory. So..that led me to this blog. I often work with Investors, and also first time buyers that will NOT offer a number that will win the bid. They are still in the past..”no matter the price, offer less..sellers are desperate..and hey, I’m cash!” Doesn’t matter..

If you have found a fantastic property that is listed fairly, it will probably garner multiple offers. Short Sales in La Quinta generate mulitples almost always..

1. Cash still trumps, but NOT if your cash offer is way below fair market value. Sellers know they will get what they have it listed at. Cash does eliminate potential contingencies and also decreases close time, so that is worth something. However, do not think you are the ONLY cash buyer..you are not.

2. Loan type: If you are a conventional loan buyer, you should offer List Price or a little above to beat out the Cash buyers on a multiple offer property. If you are FHA or asking for Closing Costs, your offer needs to be better than List price because Seller has to see a value to crediting you back your closing costs. You will be competing with Cash buyers..make your offer stronger to persuade the Seller that you are serious!

3. Clean, well written offers: Don’t tangle your offer up with contingencies, and pieces of furnishings, and this and that. Make it easy, clean and straight forward. Nobody wants to have to “figure out” what you want. Sellers want it as easy and clean as possible.

4. Cash buyers…don’t be arrogant. There are many other cash buyers in the market. Investors, foreigners, people that saved their $, people pulling cash out of CD’s and buying real estate..make an offer that makes sense!

Get there first. Submit a clean, fair offer..that means pay attention to the comps and believe them! Your Realtor should be giving you a number that will garner attention..listen! If you are interested in Short Sales, that’s for another blog..

More

.

Most Banks say, "Wasn't me!"

..but will they have any impact? The reality is that these programs are always coming up with something new such as..

Fannie Mae & Freddie Mac offer quicker Short Sale Responses

Remember that in the short sale world, the Servicer is the entity that collects your monthly mortgage payment. The Investors are the entities that actually OWN the note. Fannie & Freddie invested in millions of loans and now are left holding the bag on underwater loans. I love that they are offering these timeline guidelines. Let’s hope they actually ACT on them!!!

More

With home prices still falling in La Quinta and across America, could the housing market really be healing? That’s what two of the major U.S. banks say – Wells Fargo and Chase. Their earning reports disclosed that more Americans are taking out loans, paying them on time and taking advantage of low interest rates to refinance.

Chase, the biggest bank in the U.S., says that their income from new home loans made from January through March is record-breaking. They issued 6% more loans than this time last year and received 33% more applications.

At Wells Fargo, the bank issuing the most home loans, booked the most mortgage fees since 2009 and issued 54% more mortgages than a year ago . . . and took in 84% more applications.

As manufacturing and consumer spending have held their own or grown, the housing market has been the biggest drag on our nation’s economic recovery. Home prices are still falling, but have slowed down in the past serveral years and more than half a million American homes were in the foreclosure process at the end of March.

Yet, the stronger mortgage business reported by Chase and Wells Fargo helped to surpass Wall Street’s expectations for first-quarter earnings. Signs are encouraging and it’s a wait-and-see process as the year 2012 unfolds.

More

The number of La Quinta homes and homes across the country that received first-time foreclosure notices rose 7% in March from the previous month, marking the third consecutive monthly increase this year. This increase reflects the heightened efforts of banks in taking action against homeowners who are behind with their mortgage payments.

Some real estate experts are pointing out that we have not seen the last of rising foreclosures and that there will be many more to come down the pipeline. Foreclosure activity slowed down markedly in the fall of 2010 – that’s when claims began to surface regarding banks and mortgage servicers processing foreclosures without properly verifying documents. Since then, a $25 billion settlement was reached in February between the largest U.S. mortgage lenders and state officials. This paved the way for banks to now take action on unpaid mortgages, some of which have been hanging in limbo for months and years. These are the homes that may be looking at being foreclosed and eventually ending up back on the market.

Typically, foreclosures sell at a discounted price compared to other homes and these sales can drag down the value of neighboring properties . . . meaning that it could now take even longer for home prices in certain markets to gain value.

Some experts are saying that it’s likely that the new crop of foreclosures will arrive in smaller waves throughout the year rather than all at one time. The sad part is that even more Americans will be losing their homes, never good.

More

Bank of America; short sale lemon

Just read an article in the New York Times called Banks Always Win. How serendipitous when I am encountering that very thing with my now year long Short Sale with B of A. I have been writing of this journey because it is so unbelievable to me and the Sellers, that it deserves the written word.

When you see a Short Sale listing that has been sitting for hundreds of days and the List Price keeps going up, then back down, it’s because the appraisal came in too high, the Investors believed it, and their counter was so far over what the property is worth that the Buyer walks, shaking their head in disgust. Does B of A really think that because they have a higher value in their little pea brain it is the Reality of the homes’s value? Buyers set the value you ding dongs. It’s called a Buyers’ Market for a reason. Your property is worth what a Buyer will pay..period!

First appraisl one year ago (4/15 marks 365 days with this listing and four qualified buyers). Anyway, first appraisal comes in at $980,000. At that time, I tried to convince them that my offer of $850,000 was fair. No offers came in until the List Price had been reduced to that number from my original list price of $1,050,000. Buyer of course walks.

I raised the LP to $980,000 and began reductions. Again..no offers until I hit $850,000. B of A counters at $980,000 again. Buyer #2 walks.

I get Buyer #3 at $850,000. B of A does a new appraisal. Must’ve been closer because they counter at $865,000. Buyer accepts with a conventional loan. Lender appraises the house at $825,000. Buyer #3 walks.

I List the home at $865,000..the “approved B of A price” per the approval letter which was set for a March 15,2012 close. I get an offer of $865,000 and this time I call the Lender. Local woman and she guarantees that she will fund this loan. OK..I submit the offer. Darned if the B of A negotiator doesn’t tell me “this file is aged,” so we close and re-open it once again. New appraisal is ordered. Yippee! Surely, this time it will come in at $865,000! Not so fast…

This appraiser has decided that over the past year, the home has gone up in value to..drumroll..$1,050,000!!! Hey, wasn’t that my original List Price? Why yes it was! Sure wish I could get them that number and make more money. I get the file escalated and send in the ONLY THREE COMPS that have SOLD in this SAME NEIGHBORHOOD over the past 6 months. All support this offer..maybe a little less in fact. I’m sure this time they are going to approve this offer. But no…

B of A in their wisdom, have countered at $925,000. Now, if this home was EVER worth $925,000 we would have already received an offer at that number. Well, they say..your 3 comps are very close indeed, but the comps our appraiser sent us are higher and we are choosing to use those. REALLY???? Why go outside the exact gated community for comps? Across the freeway puts you closer to the beach..values are different. A neighboring community is valued higher because of the builder.

Did B of A hand our a booklet for their appraisers that changes the rules? Since when does using DIRECT sold comps not hold any merit? I thought the BEST comps were what give you true value for that home in that neighborhood.

Oh, the best thing. I just received my first back up offer. Agent says his clients don’t see the value of $865,000 because another Short Sale just closed in the community a couple months ago for $850,000, so they are offering $815,000 since values are declining.

Who wants to take bets that B of A runs off my Buyer #4 at $865,000 and ends up with at least $50,000 LESS when they do finally accept an offer. Hee-hee..why the banksters continue to decimate property values…

More

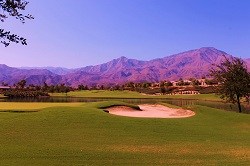

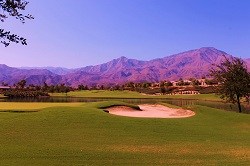

Who's paying for the view??

Who’s buying the really BIG properties..big prices and big locations? The Russians according to the New York Times. This specifically talks about New York, but it made me wonder…will they be heading here to the Palm Springs Valley any time soon?

Some of our most luxurious high end properties are on golf courses. Of course, they could BE golf courses. Porcupine Creek just sold. Escena and Palm Desert CC both sold to development companies that are now re-habbing them and building the properties out. Then there are the luxury golf developments of Bighorn in South Palm Desert. If you want a more rural surrounding, The Madison Club in La Quinta might be the one for you. Indian Wells, located centrally in our Valley offers several exclusive clubs..The Vintage is one of them. There are some glorious properties in downtown Palm Springs that just might ring your Russian Bell..

Luxury property sales here in our Valley have continued to record higher and more frequent sales through the first quarter of 2012. These sales are expected to continue through the year and into next year. Great values can be had in these higher end properties now that their List Prices are more reflective of the market.

If you’re looking for luxury..now could be the time.

More