Diamond in the rough???

Real Estate Investors are not a new thing. Investors buying LOTS of homes, however, may be. This New York Times article points out the surprising numbers of homes being purchased for Lease homes and Flipping..it’s predicted to continue to grow. Here in the Palm Springs Valley, I am seeing more and more Investors-both local and from afar-purchasing vacant or distressed properties.

What are they doing with the homes? Two things..

1. Minimum clean up. Meaning cosmetic clean up to get the home prepared to lease. The return on their investment money is much higher than parking the money in a bank, buying bonds and deemed to be less risky than the Stock Market.

2. Maximum clean up. Buying homes that REALLY need some help. Roofs, knocking down walls, adding a bathroom, updating a kitchen. These homes are then being sold. Flipping has lower long term margins, but if done correctly, can return a quicker profit to the Investor.

The key to success is having the right people in place. Realtors that KNOW the area. Scouters that can find these Realtors. Software in place to estimate repair costs and after repair values. Realtors that can re-sell the property. Is this a new Trend? Yes, I think it is. In our Valley, there are many areas that invite investors to help reduce the blight and move inventory. Both good for our Valley.

More

Last week was the first week that I received this comment from potential La Quinta home buyers..not once, but twice. Is that ubiquitous bottom, behind us?

I have no way to know for sure if we are at the bottom..in any price point. If you run into a Realtor that swears they DO know..I would suggest running. We Realtors are out in the streets daily, looking at homes, studying the inventory of available homes, looking at numbers of foreclosures that may be coming down the pike. We do have a better feel for the “bottom” than the average bear, but we do NOT have a crystal ball that predicts the future. So..are we at the bottom?

In many developments in La Quinta, Indian Wells, Rancho Mirage and Palm Desert..as well as Palm Springs proper, it appears we may be. Why? There are more Buyers looking for the same properties than there are those properties. What is everyone looking for in the desert?

- Sun orientation. South means more hours of sun. West is setting sun.

- Views. We have a unique situation in that we are a desert with mountain ranges and Buyers want to see them!

- Lot size. Large or small, Buyers want something in particular

- Water? Many Buyers demand water views or proximity

- Fairway location: HUGE here in the desert.

So..as you can surmise. If you are a buyer looking for a home with 3 of the 5 criteria above, your Inventory is very limited..no matter the price point. However, there are plenty of homes WITH the above mentioned criteria. They just are no longer only selling if they are short sales or foreclosures. Equity homes (standard sales) are now becoming more and more normal.

Buyers are still demanding a good value, just not a “steal.” The Steals are now much fewer and further in between. But, hey, look at it this way. Now you KNOW you are buying into a desirable area, right? There is nothing more comforting when you buy ANYTHING than knowing that lots of other Buyers desire exactly the same thing. Value is rising.

Views, location, sun..Buyers are paying for these!

Eldorado merges with Golden Voice

If you thought the Coachella Valley Music & Art Festival could not get any bigger, think again. Golden Voice, which operates the Festival, has just partnered with the Lake Farm owners of Eldorado Polo Club in it’s quest to increase the holdings for the Festival here in the Coachella Valley. Eldorado Polo Club sits on some of the most desirable acreage in the Valley and consists of 13 polo fields, a clubhouse, Cantina/restaurant and acres of stalls and corrals.

It’s not clear if Golden Voice actually purchased the polo club, but that may be the case. They are promising Polo as it’s always gone on..but better. During the festival, the fields will be converted into parking, tent cities and all the other things a music festival of this magnitude requires. The Coachella Music & Arts Festival is heading into it’s 12th year of continued growth and success. Now running for 2 weeks, including the ever growing Stagecoach Festival of Country Music greats, this recent purchase ensures the Music Festivals presence in the Valley for years to come…and sounds like the continued presence of the famous polo club and all the revenue the players/grooms/families and their ponies bring to the East Valley.

If you are thinking of buying a home in Indio or the East Valley..now may be much better than later.

More

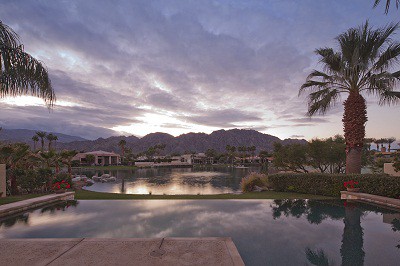

who wouldn't want to own in La Quinta???

I am working with Investors, or Investment groups from Australia, the UK, New Zealand, Canada and France..and that’s just in the first quarter of 2012. Our Real Estate market is benefitting from foreign buyers belief that the US is the best place in the world to park their money. These buyers are helping reduce our inventory and get the housing market back in balance again..come on down!

Foreign clients bought 41 billion worth of stateside houses and apartments during teh 12 month period that ended in March of 2011, according to the NAR. Pretty much the same as last year..BUT add in the $41 billion spent by immigrants who moved here within the past two years and people with visas for longer than 6 months and the total is $82 billion..up from $66 billion just a year ago.

Realtor.com is nov visible internationally and can be viewed from practically anywhere in the world..and in 12 languages. Wow! Talk about checking out real estate while in the comfort of your own home. What states are they buying in????

1. Florida- nearly 55% of all international sales from May to November, 2011 were in Florida.

2. California-appprox. 6% in California

3. Nevada-5 % of all foreign sales were here.

4. Arizona-17% of foreign investor sales were in AZ

Why in these states? Because these states have the most standing inventory! The glut of homes in these 4 states is still considerable and therefore the price/sf is the best buy..more for your international money! It’s not ALL about investment. It’s also about buying a home in a country where you want to live..even if it’s only part time.

More

Is it time to buy in our winter paradise?

Sales continue to rise here in the Palm Springs Valley. The Median keeps moving slightly down, but that is to be expected when the luxury homes are really starting to pop. So..even when the entry level homes price/sf falls slightly, the luxury home sales fall ALOT and that skews the median. Don’t put too much emphasis on the median price..look at the development in the City you are looking to buy in. Check those comps carefully for the past year and that will tell you the true story in a micro level.

This article from today’s Desert Sun emphasizes all our recent Sales. The last Q of 2011 has continued it’s steady sales numbers into the First Q of 2012. Entry level homes are pretty much consistently receiving multiple offers. I often get outbid on investor homes at this level. First Time homebuyers are taking advantage of the “First Look Initiative” for Freddie and also Fannie Foreclosures and usually beat out the Investors! This is probably a good thing for the healing of our communities.

Luxury home Sales have really started popping. PGA West continues to sell rapidly. Buyers from Australia, New Zealand, Asia, Canada, the beach cities, L.A., and many local buyers that are selling and moving up to communities they have been eyeing but were unable to afford..all are pushing luxury home sales up.

I am hearing over and over…”Where else can I put my money to diversify my portfolio and get such a strong return?” Good question…

More

PGA West custom home: $1,595,000

Luxury Home Sales for the City of La Quinta have continued to increase over the past 6 months. Luxury Home sales are homes sold for $1,000,000 +.

Luxury Home Sales by Month:

July, 2011: A total of 3 homes sold with 5 homes pending

August, 2011: A total of 7 homes sold and 7 homes pending

September, 2011: A total of 3 homes sold with 5 homes pending

October, 2011: A total of 6 homes sold and 6 homes pending

November, 2011: A total of 13 homes sold with 8 homes pending (Nice jump!)

December, 2011: A total of 9 homes sold and 8 homes pending

From July, 2011 to December 2011, there was a 200% increase in total number of Luxury homes SOLD. The Average SOLD price decreased by approximately 11% over the same 6 month period. Average days on the market has come way down too. In July, these homes were taking approx. 266 days to move, but by December, it was only 187 days. So..prices have come down a bit, homes don’t sit as long, and sales have gone up!

Interesting note: The price/sf has increased pretty steadily. In July, it was $467/sf, dropped to $328/sf in November of 2011, but by December, the average price/sf was back at $439.

La Quinta’s Luxury Homes are definately having a shorter shelf life. If you’re thinking about that luxury home, it might be a good time to get out and take a look at the Inventory in La Quinta.

More

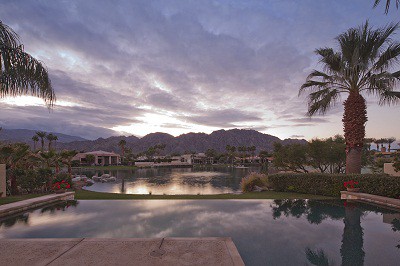

Outstanding Views bring buyers to Palm Springs area

I have noticed home prices stabilizing in most price points during the past year. It appears this is going to continue through 2012. The really good news? The Builders are back! New Home Sales is where I spent the first 5 years of my real estate career..2000-2005. I sold new homes for Medallist Golf Developments in La Quinta at Norman Estates in PGA West. In that particular development of 58 semi-custom homes, the demand is back. Will prices go back to 2006?? Of course not..at least not for many years if then. But..the Short Sales and Foreclosures in this neighborhood of $850,000 – $1.3 mil homes are about done. There may be one or two more, but the price/sf has been set and there are more Buyers than properties.

New Home developments have stood still for about 3 years now..Sun City in Palm Desert and also Shadow Hills, Indio were still building one or two new homes and Trilogy (all 55+ communities), continued to build slowly. Over the past 3 months, I am now seeing grand openings again! The best thing is that these “new” developments are really just continuations of developments that had been put on hold. Again..great for our Palm Springs Valley. Finish these abandoned or “stopped” projects..really helps a neighborhood.

Palm Springs New Home Builders are getting their mojo back!

More

Former Model home; Whitehawk

Whitehawk in Palm Desert, California is a small, private, gated community in East Palm Desert. Located off of Country Club Dr., the 10 Fwy overpass is about 5 minutes away, shopping is across the street and also around the corner on Washington St. HOA’s are only $110/month.

This Short Sale, (Listing #21446840), is unbelievable..$100/sf for this former model home with all the upgrades, bells and whistles. Built in 1996, the home has 4bd/4ba with lovely outdoor porches and splash pool. Beautifully maintained, the Seller is current on HOA’s and keeps home in perfect condition.

Bank of America has the note on this one, and there is also a HELOC with them as the 2nd. The HELOC has already been approved..just need an offer to push back the Sale Date and get this Short Sale it’s final approval!

This home is approx. 2900 sf and priced at $289,900..just $100/sf. Seller’s loss is your gain. Great investment opportunity as would be a great year round lease.

The Neighborhood of Whitehawk..

Furnishings available outside of Escrow..hurry..bring offer!!!

More

Since about the middle of 2011, I have been seeing a small but steady uptick in local prices. The bottom price point of $250,000 and under is saturated with Buyers. Investors and also first time home buyers. The numbers of foreclosures and Short Sales have dropped significantly. This trend will most like go through 2012 with the price/sf increasing a small amount.

Then there is the $500-$800,000 market. Again..I’m seeing lots of buyers. Sellers have priced their homes much more aggressively and they are moving. There is still room to negotiate here, but less inventory than a year ago.

Luxury hoemes are the hot market. The price/sf has dropped over 30% and in some developments as much as 50% from the peak market of 2006. Investors in this price point have increased and I expect this market to continue to see investors and home buyer numbers continue to rise through 2012.

Palm Springs Valley Real Estate Economic Summit Update:

This is great news for those of us that live here year round. It is also an indicator that it might be time for those of you looking to invest or own in our beautiful winter, resort valley to make that offer!

More

If the Banks won’t do it, private investors will! Investors from Canada are coming to the desert in droves, picking up Short Sales or Foreclosures and leasing them..I have several Buyers from both Vancouver and also Calgary that are doing just that. They are also buying homes to live in themselves in our desert paradise, but rentals are a great return on your money. Especially when you buy them for much less than it would cost to replace them..as our housing market is right now.

This investment group is made up of Canadians mostly, but I suspect there are plenty of American Investors in it also..

The La Quinta and Palm Springs area real estate markets in general are on fire..not like the craziness of the 2004-2006 years. This is a reasonable, controlled burn. Houses are being purchased, leased, or lived in with the sane expectations that in 5-10 years, there will be resale profits. Of course, there ARE contractors and groups purchasing “fixers” and re-selling them when done..that is very popular here.

If you don’t live here, probably not best to purchase “flippers”..pretty risky over-seeing your help. Cosmetic fixers..sure. Buy low, lease at a good return/month, and plan to sell at a comfortable profit down the road..

More